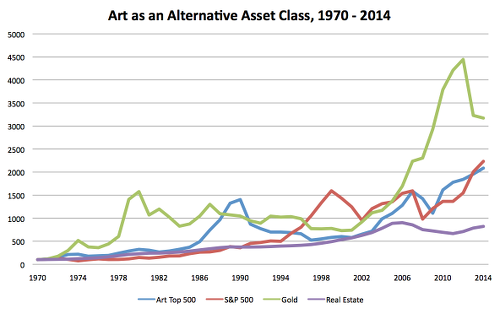

Graph showing the

dip in the art market in the early 1990s as well as the striking

recovery following

the 2008/09 crisis, based on the top 500 artists and compared

to the development

of gold and real estate prices, as well as the Standard & Poor's

500 stock market

index. © Roman Kräussl / University of Luxembourg

(January 6, 2016) Researchers

at the University of Luxembourg are warning of an overheating art market, one

of the fastest-growing investment sectors of the past decade, after applying a

new bubble detection method analysing millions of auction records.

About market growth

in the art sector

Few sectors of the market have rebounded as robustly as

art—particularly contemporary art, which has doubled in value since the

beginning of the financial recovery following the 2008/09 financial market

crisis.

Pundits on the side-lines have commented that such market

growth is unsustainable, warning there is a bubble in the making that is sure

to burst, as seen in the early 1990s and in 2008/09. Headline-grabbing sales of

post-war and contemporary works for over $100 million appear to support this

argument. But is a bubble really forming?

Market bubbles are generally defined as a dramatic

escalation in the volume of trading in assets at prices that exceed their

fundamental value, followed by a sudden collapse. Rational expectations put the

fundamental value of an asset as equal to its expected discounted cash flow.

For most assets it is relatively easy to project this value—for example through

dividends on stocks or rent on real estate. In the case of art, however,

returns can rarely be correlated to costs of production.